Custom Manufacturing Industry podcast is an entrepreneurship and motivational podcast on all platforms, hosted by Aaron Clippinger. Being CEO of multiple companies including the signage industry and the software industry, Aaron has over 20 years of consulting and business management. His software has grown internationally and with over a billion dollars annually going through the software. Using his Accounting degree, Aaron will be talking about his organizational ways to get things done. Hi ...

…

continue reading

Contenido proporcionado por Not Your Average Financial Podcast™. Todo el contenido del podcast, incluidos episodios, gráficos y descripciones de podcast, lo carga y proporciona directamente Not Your Average Financial Podcast™ o su socio de plataforma de podcast. Si cree que alguien está utilizando su trabajo protegido por derechos de autor sin su permiso, puede seguir el proceso descrito aquí https://es.player.fm/legal.

Player FM : aplicación de podcast

¡Desconecta con la aplicación Player FM !

¡Desconecta con la aplicación Player FM !

Episode 365: Retirement Savings Sabotage! Why 90 Percent of IULs Fail… and What To Do

Manage episode 436996918 series 1610796

Contenido proporcionado por Not Your Average Financial Podcast™. Todo el contenido del podcast, incluidos episodios, gráficos y descripciones de podcast, lo carga y proporciona directamente Not Your Average Financial Podcast™ o su socio de plataforma de podcast. Si cree que alguien está utilizando su trabajo protegido por derechos de autor sin su permiso, puede seguir el proceso descrito aquí https://es.player.fm/legal.

In this episode, we ask:

- Are we in a retirement crisis in this country?

- How was that agent trained?

- What is the problem with indexed universal life insurance (IUL)?

- Have you read the book Becoming Your Own Banker by Nelson Nash?

- Would you like to hear Episode 312?

- Have you read Pamela Yellen’s book The Bank on Yourself Revolution?

- What did the estate planning attorney say?

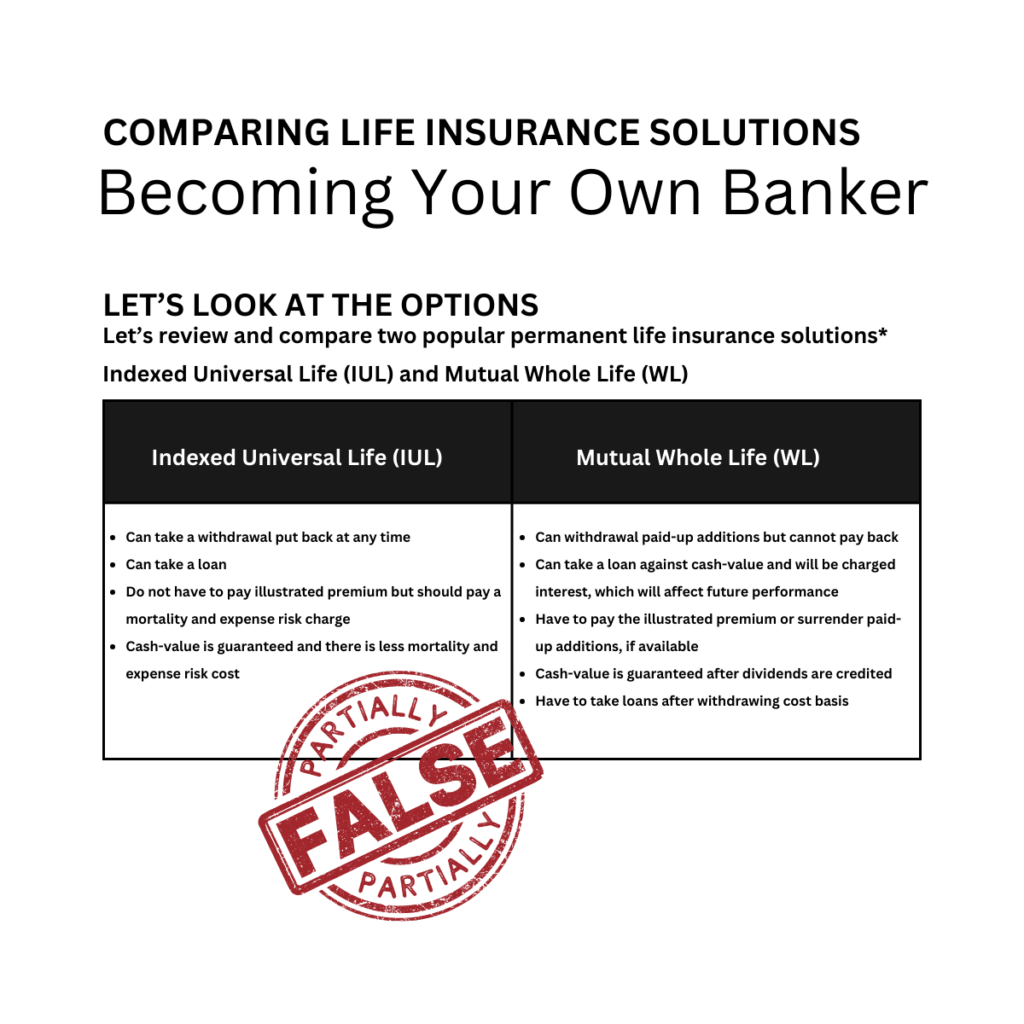

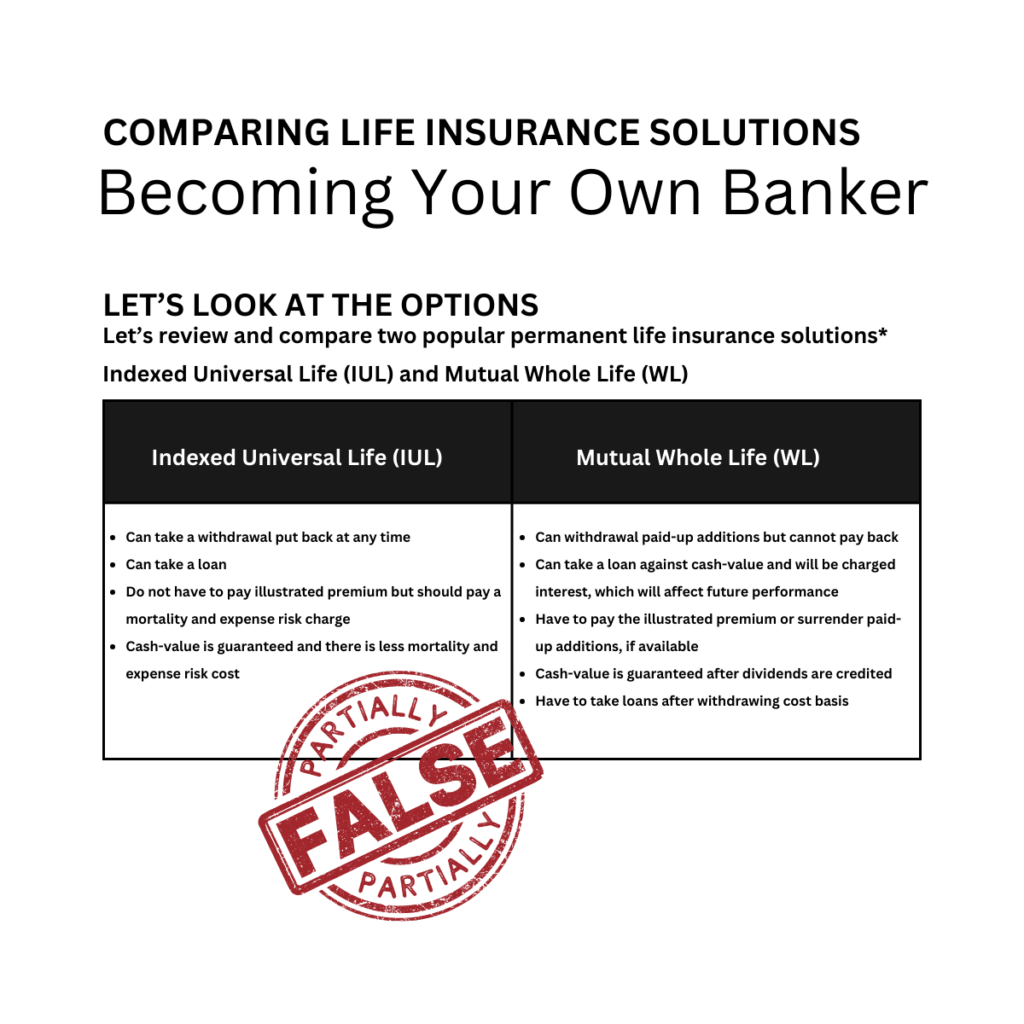

- What was on the Comparing Life Insurance Solutions document (see readable image of document below)?

- Have you been tricked?

- What’s in the fine print?

- What about withdrawals?

- Can you put money back into an IUL after a withdrawal?

- What is the main purpose of a life insurance company?

- What about the investment portfolio?

- What do insurers make on their overall portfolio?

- What types of investments are in the insurer’s portfolio?

- Who believes 7%?

- What is mathematically impossible?

- What rate of return is legally shown on the statements?

- Is there such a thing as an average rate of return?

- What will the insurers do with an IUL contract?

- Do you remember the Fast and the Furious, etc.?

- What happens if you take a loan from an IUL and the market crashes?

- What is the feature?

- What about the insurance expenses?

- Why is that IUL cash value shrinking?

- Why does the cost of insurance go up every single year in an IUL?

- What about tax-free loans with an IUL?

- What happened to the IUL writing agent?

- How much are you taking out each year to supplement your retirement?

- How many years are you getting 0 on your index?

- Do you have income to pay down the IUL policy loans?

- What adds to the pressure?

- What happens to 88% of IUL policies?

- How many IUL policies pay a death claim?

- What if your IUL policy lapses with gains inside of the contract?

- How long do you have to pay the taxes?

- What is the over loan protection rider for those age 75+?

- What about properly set up permanent dividend paying whole life insurance, from a mutual insurance company that offers non-direct recognition loans?

- What is true?

- What happens if you totally ignore the policy loan?

- When does a policy risk lapsing?

- What about flexibility?

- How about a thought exercise, a tale of two contracts?

- What happens when you’re in your in your eighties and can’t pay the higher premiums?

- What are the guarantees in IUL?

- What are the guarantees in whole life?

- What is annual renewable term insurance (ART)?

- What about costs?

- What are the differences?

- What are the limits of an IUL?

- What is a reduce paid up policy (RPU)?

- Can one RPU an IUL?

- What about the strength of dividends?

- What should this document say about whole life insurance?

- What is the cost basis?

- What about the rules for policy loans?

- Why the ommissions on the IUL side?

- What is a stalwart of several centuries of financial stability?

- What is the big experiment of modern times?

- What almost never pays a death benefit?

- What about the gains being taxable?

- What about the tax implications for beneficiaries of IUL policies?

- What is the 1035 exchange?

- Can one 1035 exchange from an IUL into a whole life policy?

- Who’s in your corner to help you navigate and interpret all of this jargon?

- Would you like to meet with Mark or one of Mark’s colleagues?

332 episodios

Manage episode 436996918 series 1610796

Contenido proporcionado por Not Your Average Financial Podcast™. Todo el contenido del podcast, incluidos episodios, gráficos y descripciones de podcast, lo carga y proporciona directamente Not Your Average Financial Podcast™ o su socio de plataforma de podcast. Si cree que alguien está utilizando su trabajo protegido por derechos de autor sin su permiso, puede seguir el proceso descrito aquí https://es.player.fm/legal.

In this episode, we ask:

- Are we in a retirement crisis in this country?

- How was that agent trained?

- What is the problem with indexed universal life insurance (IUL)?

- Have you read the book Becoming Your Own Banker by Nelson Nash?

- Would you like to hear Episode 312?

- Have you read Pamela Yellen’s book The Bank on Yourself Revolution?

- What did the estate planning attorney say?

- What was on the Comparing Life Insurance Solutions document (see readable image of document below)?

- Have you been tricked?

- What’s in the fine print?

- What about withdrawals?

- Can you put money back into an IUL after a withdrawal?

- What is the main purpose of a life insurance company?

- What about the investment portfolio?

- What do insurers make on their overall portfolio?

- What types of investments are in the insurer’s portfolio?

- Who believes 7%?

- What is mathematically impossible?

- What rate of return is legally shown on the statements?

- Is there such a thing as an average rate of return?

- What will the insurers do with an IUL contract?

- Do you remember the Fast and the Furious, etc.?

- What happens if you take a loan from an IUL and the market crashes?

- What is the feature?

- What about the insurance expenses?

- Why is that IUL cash value shrinking?

- Why does the cost of insurance go up every single year in an IUL?

- What about tax-free loans with an IUL?

- What happened to the IUL writing agent?

- How much are you taking out each year to supplement your retirement?

- How many years are you getting 0 on your index?

- Do you have income to pay down the IUL policy loans?

- What adds to the pressure?

- What happens to 88% of IUL policies?

- How many IUL policies pay a death claim?

- What if your IUL policy lapses with gains inside of the contract?

- How long do you have to pay the taxes?

- What is the over loan protection rider for those age 75+?

- What about properly set up permanent dividend paying whole life insurance, from a mutual insurance company that offers non-direct recognition loans?

- What is true?

- What happens if you totally ignore the policy loan?

- When does a policy risk lapsing?

- What about flexibility?

- How about a thought exercise, a tale of two contracts?

- What happens when you’re in your in your eighties and can’t pay the higher premiums?

- What are the guarantees in IUL?

- What are the guarantees in whole life?

- What is annual renewable term insurance (ART)?

- What about costs?

- What are the differences?

- What are the limits of an IUL?

- What is a reduce paid up policy (RPU)?

- Can one RPU an IUL?

- What about the strength of dividends?

- What should this document say about whole life insurance?

- What is the cost basis?

- What about the rules for policy loans?

- Why the ommissions on the IUL side?

- What is a stalwart of several centuries of financial stability?

- What is the big experiment of modern times?

- What almost never pays a death benefit?

- What about the gains being taxable?

- What about the tax implications for beneficiaries of IUL policies?

- What is the 1035 exchange?

- Can one 1035 exchange from an IUL into a whole life policy?

- Who’s in your corner to help you navigate and interpret all of this jargon?

- Would you like to meet with Mark or one of Mark’s colleagues?

332 episodios

Tüm bölümler

×Bienvenido a Player FM!

Player FM está escaneando la web en busca de podcasts de alta calidad para que los disfrutes en este momento. Es la mejor aplicación de podcast y funciona en Android, iPhone y la web. Regístrate para sincronizar suscripciones a través de dispositivos.