¡Desconecta con la aplicación Player FM !

Money Talk Podcast, Friday April 12, 2024

Manage episode 412194822 series 1036924

Landaas & Company newsletter April edition now available.

Advisors on This Week’s Show

Kyle Tetting

Art Rothschild

Mike Hoelzl

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (April 8-12, 2024)

Significant Economic Indicators & Reports

Monday

No major announcements

Tuesday

No major announcements

Wednesday

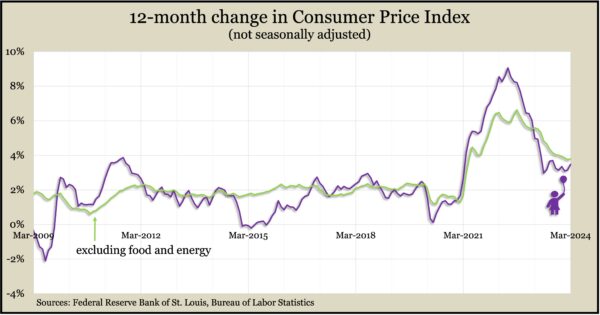

Overall inflation continued to stall in March, staying above the Federal Reserve’s long-term target. The Consumer Price Index, the broadest measure of inflation, rose to a 3.5% year-to-year rate, bouncing higher for the second month in a row after falling from as high as 9.1% in June 2022. The Bureau of Labor Statistics said increased costs for shelter, gasoline and car insurance contributed to faster inflation, keeping it above the Fed’s long-range target of 2%. A core measure of CPI, which excluded volatile food and energy prices, stayed at a year-to-year rate of 3.8% for the second month in a row.

Thursday

Inflation on the wholesale level rose in March with the Producer Price Index gaining 0.2%, only one-third of the advance in February. The Bureau of Labor Statistics said the index rose 2.1% from March 2023, the fastest 12-month pace in 11 months. Costs for services increased while goods prices declined overall, led by gasoline. The core Producer Price Index – excluding volatile prices for energy, food and trade services – rose 0.2% from February and was up 2.8% from the year before, on par with the yearly rate since May.

The four-week moving average for initial unemployment claims dipped for the second time in three weeks, reaching 42% below the long-term average since 1967. The measure of employers’ reluctance to let workers go was 3% above its level just before the COVID-19 pandemic, according to data from the Labor Department. Altogether, just under 2 million Americans claimed jobless benefits in the most recent week, down 3.6% from the week before but up 5% from the same time last year.

Friday

A preliminary April reading of consumer sentiment shows Americans have registered little change since January. The survey-based index from the University of Michigan has been midway between an all-time low in mid-2022 and the optimism level just before the pandemic four years ago. Surveys showed a slight increase in expectations for inflation, which the university said might suggest some frustration with an apparent stalling in the slowdown of inflation.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 16175, down 73 points or 0.5%

- Standard & Poor’s 500 – 5123, down 81 points or 1.6%

- Dow Jones Industrial – 37984, down 920 points or 2.4%

- 10-year U.S. Treasury Note – 4.50%, up 0.12 point

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.

Landaas newsletter subscribers return to the newsletter via e-mail

13 episodios

Manage episode 412194822 series 1036924

Landaas & Company newsletter April edition now available.

Advisors on This Week’s Show

Kyle Tetting

Art Rothschild

Mike Hoelzl

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (April 8-12, 2024)

Significant Economic Indicators & Reports

Monday

No major announcements

Tuesday

No major announcements

Wednesday

Overall inflation continued to stall in March, staying above the Federal Reserve’s long-term target. The Consumer Price Index, the broadest measure of inflation, rose to a 3.5% year-to-year rate, bouncing higher for the second month in a row after falling from as high as 9.1% in June 2022. The Bureau of Labor Statistics said increased costs for shelter, gasoline and car insurance contributed to faster inflation, keeping it above the Fed’s long-range target of 2%. A core measure of CPI, which excluded volatile food and energy prices, stayed at a year-to-year rate of 3.8% for the second month in a row.

Thursday

Inflation on the wholesale level rose in March with the Producer Price Index gaining 0.2%, only one-third of the advance in February. The Bureau of Labor Statistics said the index rose 2.1% from March 2023, the fastest 12-month pace in 11 months. Costs for services increased while goods prices declined overall, led by gasoline. The core Producer Price Index – excluding volatile prices for energy, food and trade services – rose 0.2% from February and was up 2.8% from the year before, on par with the yearly rate since May.

The four-week moving average for initial unemployment claims dipped for the second time in three weeks, reaching 42% below the long-term average since 1967. The measure of employers’ reluctance to let workers go was 3% above its level just before the COVID-19 pandemic, according to data from the Labor Department. Altogether, just under 2 million Americans claimed jobless benefits in the most recent week, down 3.6% from the week before but up 5% from the same time last year.

Friday

A preliminary April reading of consumer sentiment shows Americans have registered little change since January. The survey-based index from the University of Michigan has been midway between an all-time low in mid-2022 and the optimism level just before the pandemic four years ago. Surveys showed a slight increase in expectations for inflation, which the university said might suggest some frustration with an apparent stalling in the slowdown of inflation.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 16175, down 73 points or 0.5%

- Standard & Poor’s 500 – 5123, down 81 points or 1.6%

- Dow Jones Industrial – 37984, down 920 points or 2.4%

- 10-year U.S. Treasury Note – 4.50%, up 0.12 point

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.

Landaas newsletter subscribers return to the newsletter via e-mail

13 episodios

Todos los episodios

×Bienvenido a Player FM!

Player FM está escaneando la web en busca de podcasts de alta calidad para que los disfrutes en este momento. Es la mejor aplicación de podcast y funciona en Android, iPhone y la web. Regístrate para sincronizar suscripciones a través de dispositivos.